Billing Service Type Overview

Summary

Billing Service Type is a vehicle for categorizing medical activity for one of two purposes. First, service types are used for reporting revenues so that the Occupational Health Clinic management can review revenues by broad areas, such as product line. Service types are often used for reporting up the management tree where there the greater detail provided by, say, revenue by visit categories is unnecessary. At higher levels there might be an interest in knowing revenue from Workers' Comp visits, but no interest in how much came from initial visits vs rechecks. While the revenue from physicals might be important, the amount from post-offer physicals vs hazmat, etc might not.

The second use for service types is in identifying groups of services that receive special handling during billing.

What are some specific service types?

Typically, billing service types represent lines of business that your management tracks. Your organization will need to decide what service types to create, and the decisions will be based on your particular needs. For purposes of revenue reporting, we recommend at a minimum that you set up a Service Type for each of these three types of business that are performed in your clinic.

-

Employer Services

-

Workers Comp Services

-

Private Practice Services (if you are doing Private Practice).

Other examples might include:

-

PT

-

Rehab Labs

-

Physicals

-

Substance Abuse Testing

-

On-Site Services

-

Consulting

Service Types in Visit Categories

Visit categories are always linked to service types so that all the revenue from visits of that category is reported as belonging to the linked billing service type. This means that the revenue from a single medical activity is reported one way if it occurs in an employer visit, for instance, but a different way if it occurs during an urgent care visit. How it specifically is reported depends on the billing types that your organization sets up.

For example, the revenue from an hepatitis B vaccine that occurs in an employer physical might be counted in a revenue category called Employer Physicals because it occurred in a visit whose category is linked to that service type. If the same hepatitis B vaccine occurs during an Urgent Care visit, the revenue would then be classified in the revenue reporting category Urgent Care because the visit category is linked to the service type called Urgent Care.

Service Types in Medical Activities

If some services should be counted as belonging to a different service type from the rest of the visit, the medical activities can be linked to the billing service type. If a medical activity itself is directly linked to the billing service type, the revenue from that particular medical activity will always be classified as that service type, regardless of the billing service type the visit category is linked to.

The most common example of medical activities that are linked directly to service types are drug and alcohol screens, which are typically all linked to a service type called something like Substance Abuse Testing. Linking medical activities directly to service types gives you an ability to identify all of one type of activity which cuts across visit categories. You can report on the revenue from all drug tests, regardless of whether they occurred on a Workers' Comp visit, a post-offer physical, a drug screen only visit or any other category of visit.

You should have very few medical activities linked directly to service types since linking via the visit category enables greater flexibility in revenue reporting.

Using Service Types for Split Billing

There are some medical activities that you may want to identify with specific service types for purposes of split billing refers to any visit that requires billing more than one party for the services (e.g. billing the carrier for Comp services and the employer or lab for the drug screen). . That way, regardless of the visit, those activities will always be billed to the same payer. The most common example is post accident drug screens which are usually billed to the employer even when performed on a Workers' Comp visit. If you identify a specific medical activity in this way, you can log a single visit for the injury, enter all the medical activities including the drug screen, and, if you have set up the system properly, the program will automatically bill the injury charges to the carrier and the drug screen charge to the employer. However, there is a a better method than using service types to accomplish the same purpose. That is to flag those types of activities in the employer's company protocol. This is a safer method, because sooner or later you will find an employer who wants to bill the same service to a lab.

Using Service Types for Alternate Bill-To Addresses

It is not uncommon to have some employers who want you to create a separate invoice for all substance abuse testing. That invoice might or might not go to a different contact and/or address. We call this alternate bill-to addressing. It can be accomplished by adding a service type to all substance abuse tests. Doing so gives you a way of identifying all of this type activity that cuts across visit categories. It becomes possible to select all drug tests, regardless of whether they occurred on a Workers' Comp visit, a post-offer physical, or a drug screen only visit.

Using Service Types for Services Contracts

While an activity can be billed to a third party payer by setting it up to do so on a company specific visit category protocol, that can be tedious. It require first of all that you have a company protocol for every type visit being billed to that payer. If this only includes a drug screen collection on a couple physicals, that method works well. But what if all of a company's substance abuse testing goes to a TPA, regardless of visit type? Suppose further that the company does not otherwise need and company specific protocols. You would then have to create a company protocol for every visit category that includes a drug test, and set each drug test to be billed to the TPA.

A service contract defined with a service type is a much easier way. This lets you tell the program in one place that all activity which has the substance abuse service type should be billed to the TPA. With that done, without entering any company protocols, the TPA will receive the invoice with all drug tests.

Billing Professional Services on the CMS 1500 when you use the UB-04

Some clinics must separate the invoicing for Workers' Comp visits, billing professional services on a CMS 1500 invoice while using the UB-04 for the remainder of the visit. This requires special setup which involves the Billing Service Type. See the instructions below.

Workers' Comp Case Invoices

Using Workers' Comp Case Invoices requires creating a Billing Service Type for that purpose. See the instructions below.

What Do You Want To Do?

View pre-loaded Billing Service Types

How to Set Up Service Types

-

On the Home Nav Bar click Setup/Admin.

-

Click Medical Codes.

-

Click the Service Types button.

-

To add a Service Type, click Add. To change an existing service type click Change. (Changing a service type is not recommended. If you do so, all activity ever recorded with that service type will now appear with the changed one.)

-

Enter the Service Type in the field marked Description.

-

In the Billing Type drop down menu, select "No Billing Override", unless you will ALWAYS bill activities with this service type to the employer. In that case, select Employer Service.

-

If your Billing System Parameters are set up for certain features, there will also be a field for entering Financial Class. Enter the correct one for Billing Service Types related to one of those features which include:

-

Billing professional services on a CMS-1500 form.

-

Workers' Comp case invoices.

-

-

When you are finished, click OK.

-

Repeat steps 4 through 7 to add other service types.

-

When you are finished, click Close to close the window.

How to Change or Delete a Service Type

Deleting

You can only delete a service type that has never been used.

-

Highlight the service type to delete and click the Delete button.

-

When the program asks if you are sure, click Yes.

-

If the service type has never been used, it will be deleted. If it has been used, the program will display a message telling you that it cannot be deleted.

Changing

Do NOT change a service type that has been in use. If you do, all activity associated with it in the past will now appear to be associated with the activity you change it to.

How to add service type to visit categories

-

On the Home Nav Bar click Setup/Admin.

-

Click Medical Codes.

-

Click the Visit Categories button.

-

Search for and select the visit category to which you want to add a service type.

-

Click the BILLING tab.

-

Click the Billing Service Type table icon.

-

Search for and select the appropriate service type.

-

Click OK.

-

Repeat steps 2 through 6 to add service types to additional visit categories.

-

When you are finished, click Close to close the window.

How to add a service type to medical activities

-

On the Home Nav Bar click Setup/Admin.

-

Click Medical Codes.

-

Click the button Medical Activities.

-

Locate and select the medical activity you want.

-

Click the BILLING tab.

-

If you want to ensure this medical activity is always billed to the employer, or is always categorized for reporting as a specific service type, add a service type to the medical activity. (The service type must also be set up for Employer Services billing only, if it is always to be billed to the employer.) If you leave this field blank, the program will use the service type defined in the visit category to classify for revenue reporting. To add a service type, click the icon to the right of the Billing Service Type field, then select the service type that is appropriate for this medical activity.

-

When you are finished, click OK.

-

Repeat steps 3 through 7 until you have finished entering all the fees and (if desired) service types for the medical activities.

-

When you are finished, click Close to close the window.

Use a Service type for an alternate bill-to address

Use a service type for a services contract

Bill professional services on the CMS-1500 when UB-04 Used for Worker's Comp

To use the CMS-1500 form to bill professional services when the UB-04 is the form you use for Workers' Comp takes several actions:

-

First, you have to tell the program that you want to do this.

-

Next, a Billing Service Type must be created which can be associated with professional services.

-

Finally, the medical activities which are to be considered professional services (and hence, billed on the CMS-1500) must be linked to the billing service type.

Here are the steps to take:

-

From the Home Nav Bar

-

Select Setup/Admin

-

Select Billing Setup

-

Select Billing System Parameters

-

Select Invoices & Statements tab

-

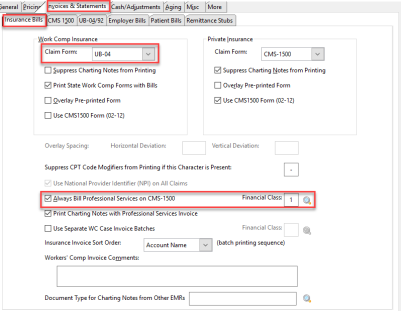

On the Insurance Bills tab click the drop-down arrow beside Workers' Comp, and select UB-04

-

Select the drop-down arrow beside Workers' Comp, and select UB-04

-

The checkbox for Always Bill Professional Services on the CMS-1500 will become available. Check it.

-

Enter a Financial Class.

-

Select Save

-

Click Medical Codes of the SETUP tab.

-

Click the Billing Service Types button.

-

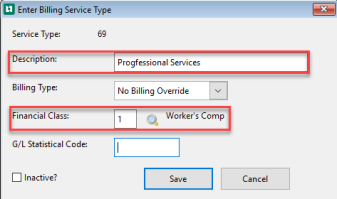

Click Add.

-

Enter a Code and a Description. The Description will probably be something like "Professional Services".

-

Click the table icon beside Financial Class.

-

If the Financial Class you want is not on the list, add it.

-

Highlight the Financial Class you want and click Select.

-

Click OK.

-

Still on Medical Codes, click the Medical Activities button.

-

Search for and select the first medical activity which is to be billed as a professional service.

-

Click the BILLING tab.

-

Click the drop-down arrow beside Billing Service Type.

-

Highlight the service type for professional services.

-

Click Select.

-

Click OK.

-

Repeat steps 16 - 21 for all professional services medical activities.

-

Click Close.