Entity Fee Schedules

If you haven't already done so, please read Fee Schedules Overview before proceeding.

Summary

For larger organizations licensed for multiple business entities, the software allows you to set up separate fee schedules for each business entity. Like clinic fee schedules, this feature was designed to allow separate pricing for health systems whose hospitals charge different prices for the same services. Your Account Manager can help you determine whether you need to set up separate fee schedules, if you are using the software to bill for several legal entities. This pricing can be used for employer service billing, Workers Comp billing, Private Practice billing, or any combination.

What Do You Want To Do?

Tell the software to use the entity fee schedules

Steps to set up a state fee schedule

-

On the Home Nav Bar, click Setup/Admin.

-

Click Billing Setup.

-

Click the State Fee Schedules button.

-

For Schedule Type indicate whether this is a Workers' Comp or Private Practice fee schedule.

-

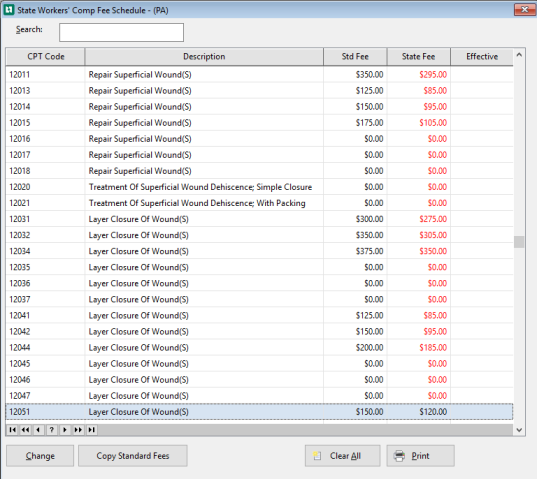

Type in the state abbreviation, then click OK to display the [State Workers' Comp Fee Schedule - (state)] window.

-

Optionally, click Copy All Standard Fees to copy all fees from the standard Workers' Comp fee schedule into this state fee schedule.

-

To add fees specific to this state, double click the first item on the list, or highlight any item and click Change.

-

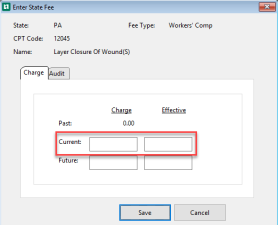

In the field marked, Current Charge, enter the fee for this service for this state schedule.

-

Click Save to add the amount. You will be returned to the State Fee Schedule window.

-

Repeat steps 4 through 6 for each fee, to enter the fees for all the items on your list.

-

If you decide you want to start over, click Clear All to remove all state fees.

-

Close the window using the red X.

Print the fee schedule

To print the fee schedule, click the Print button in the lower right side of the [State Fee Schedule] window.